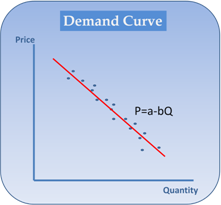

- Tradeoff Between Price and Quality

Products are characterized by both their price and quality. Quality is based on four basic characteristics (shelf life, efficiency, specific gravity and environmental affects). In each market customers have different preferences. The higher quality the product, the higher is the price customers are willing to pay.